IRS Private Letter Ruling 201342017 is a ruling that involved a Ponzi scheme in an IRA. An IRA owner we will call "Alex" asserted that his failure to complete his IRA rollover within the 60-day rollover window was because his financial adviser engaged in a Ponzi scheme.

Alex had an IRA annuity. He opened a self-directed IRA with a different firm (Company E) to invest in income producing real estate. "George" was the president of Company E. Alex closed out his IRA annuity and transferred the balance to the self-directed IRA. Shortly afterwards, his IRA was invested in real estate.

Alex had an IRA annuity. He opened a self-directed IRA with a different firm (Company E) to invest in income producing real estate. "George" was the president of Company E. Alex closed out his IRA annuity and transferred the balance to the self-directed IRA. Shortly afterwards, his IRA was invested in real estate.

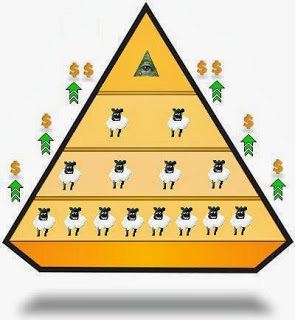

Alex intended that the funds transferred from his IRA annuity to the self-directed IRA would remain in an IRA. But later, as a result of a federal investigation, Alex learned that George had engaged in a Ponzi scheme.

As it turned out, Company E was not even qualified to act as an IRA custodian, so Alex’s "IRA" was not a qualified IRA. As a result, the movement of his IRA money into the non-IRA account was not a tax-free direct (trustee-to-trustee) transfer between IRAs. Instead, it was treated as a taxable IRA distribution when the funds were paid out of his IRA annuity and not rolled over to an IRA within 60 days.

To avoid the taxes, Alex wanted to roll the money back into an IRA, but the 60-day period was over. He asked the IRS for a 60-day rollover waiver as a result of the Ponzi scheme.

Fortunately, the IRS gave him more time to do the rollover. Alex proved that the reason he didn’t timely complete the rollover was due to George’s misrepresentation and fraud with respect to the money Alex trusted him to invest inside an IRA.

-By Joe Cicchinelli and Jared Trexler

60 Day Rollover Waiver When IRA Was Involved in a Ponzi Scheme

Tuesday, December 17, 2013

No comments

0 comments:

Post a Comment